How to sell and process manual and GoCardless direct debits

Overview

When a new client arrives at your reception desk or is on the phone, and wishes to join and pay for a subscription membership with a direct debit, they will have to be added to Sports-Booker (See screen 1 below). Their details will need to be sent to the bank to process a new direct Debit Mandate.

It is also assumed that since the date you set for your Direct Debit run may fall on a weekend or bank holiday, Sports Booker will allow 7 days from the date set for the DD run, for confirmation from the bank that all DD’s have been collected, and also a list of any failures.

You will need to ensure you have set up the appropriate payment method/direct debit by going to Settings > Financial > Payment options and turning on either manual direct debit or GoCardless, depending on which one you intend to use.

The Joining Process

Let us assume the date is the first of the month, and that you do direct debit collections on the 21st of each month and your bank needs two weeks notice period of a new mandate before it can be processed for the first time.

1. You will need to check if there is enough time before the next direct debit run date for the bank to process, and if not, set the DD collection date for the first available run that gives you enough time. The dates you will run your DD on will be chosen by your site administrator, and there may be two runs a month, for example the 14th and 28th of the month.

2. In our example, it is now the seventh of the month, the next run is on the 21st, so we have the minimum two weeks’ notice required.

3. So the first direct debit date can be set at 21st of the month.

4. IF your client wishes to join immediately and use your facilities, there will be a gap between todays date and the date by which you will know they have paid by Direct Debit.

5. This gap is covered by the “gap fee” and is the pro-rated amount for the cost of a membership from Todays date to the DD Date + 7 days (which will be the Renewal Date).

Example:

• The monthly fee is £45.

• Today is the 7th of the month.

• A client joins, and the DD run date is the 21st.

• The client needs to pay in cash or card for the gap between today and the DD+7 days i.e. to pay up until the 28th of the month.

• This is 28 – 7 = 21 days of membership • (21/30 * £45) = £31.50 this is the GAP FEE.

• This will give them a membership up to the 28th of the month. When their DD is processed and confirmed, it will push forward to the 28th of the next month.

The Processing

From the reports section of Sports Booker, you can select the DD report screen and by using the filters create two output lists that can be emailed to your bank.

The first is a file of new clients to have their mandates added.

The second is a file containing all the details for the bank to process a DD dun on a specific date.

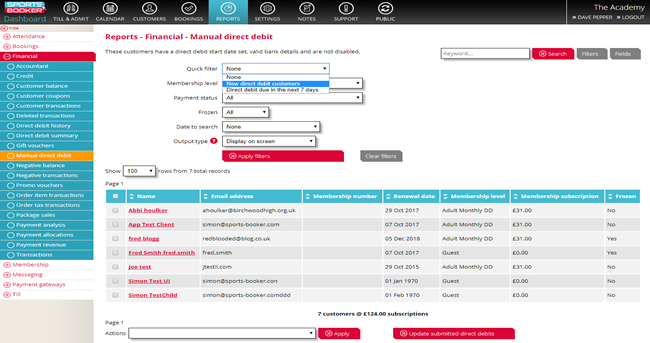

There are ‘quick filters’ which can automatically select all the new joiners, and also all the DD’s that need to be run in the next 7 days.

Once the output file has been created and sent to the bank, there is a button that will change the status of all those clients whose DD’s have been sent to a ‘pending status’.

On the DD run date, all clients are assumed to have paid successfully and Sports Booker automatically changes their status to paid.

The manual task is to deal with the failed DD’s as notified by the bank. This is achieved by tagging the clients whose DD was not paid, and “Freezing” their account, pending a cash/card payment for the outstanding balance.

Example with screenshots

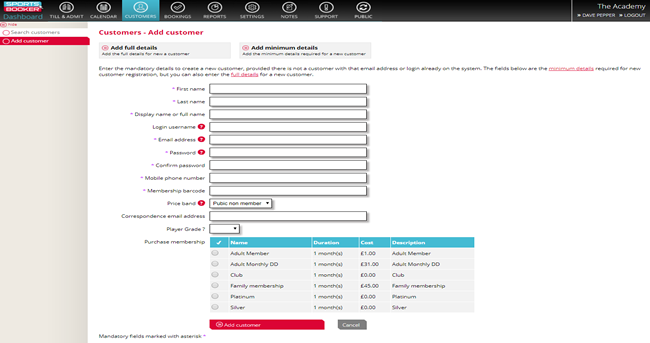

1. A new client’s details are added by going to the Customers section at the top of the dashboard, and then adding customer either with minimum or full details. Alternatively, you can go to an existing customer and select the membership tab.

2. If you added a new customer, at the bottom of the form you can select the membership type, and you will have been asked for all the bank details, provided thay have been checked in the data capture settings.

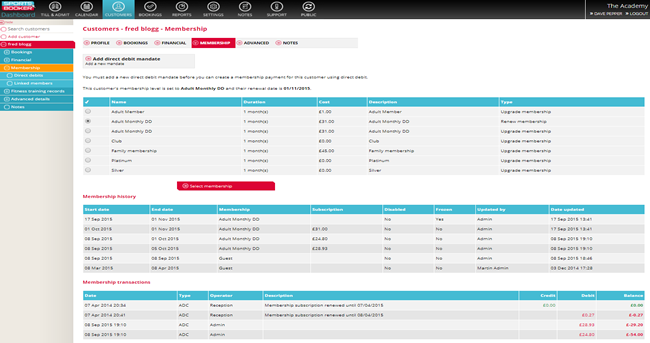

3. If you are amending an existing customer then click on the membership section. This then shows all the memberships they can purchase.

Choose the appropriate one and click on select membership, and then select the particular type of Direct Debit you are setting up.

You will need to add a new direct debit mandate if you have not already set up one for this customer.

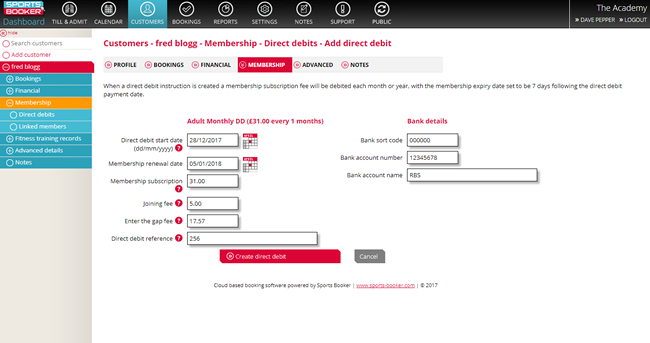

4. Next you will see the details to be entered and confirmed for the new mandate.

5. Change the DD start date to your next DD run date, that is more than 2 weeks away.

6. This will then calculate the new renewal date, and the correct gap fee to be paid to pay for the membership from now until the renewal date.

7. This Gap Fee can be over-ridden if required.

8. If you have taken a manual mandate and had it signed, as a backup copy (some banks may insist) then you can file this sequentially in a lever arch file, and assign the document the next number in sequence, and enter that number in the DD reference box, so you can always locate the original.

9. Add in the 8 digits bank account number, and the 6-digit sort code. Then click on Create direct debit.

GoCardless information: Sports Booker will instruct GoCardless automatically on the DD date, and should the payment fail GoCardless will email you, and their membership will expire on the renewal date. If it is successful then the renewal date will be pushed forwards a month automatically.

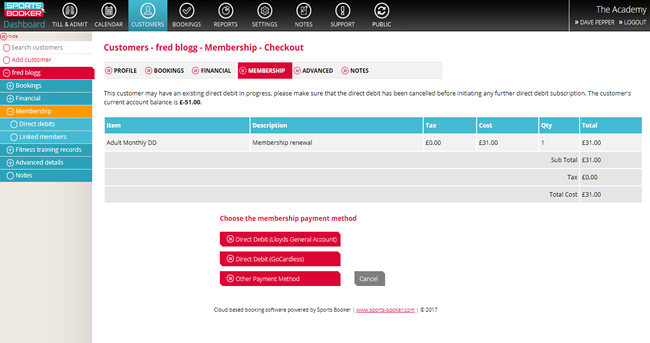

10. The confirmation screen will show, and also a button to allow you to upload the DD hard copy if you have digitally scanned it. The client will automatically get an email confirmation (see messaging settings) and a print out confirmation is possible too. The next stage is to go to the checkout to pay for the gap fee, by clicking on Checkout.

11. Using the checkout, choose the payment method (or send the transaction to the till where appropriate).

12. Success! You have created set up a DD for a customer, and collected the fee due from now until their DD will be known to be paid.

Processing example

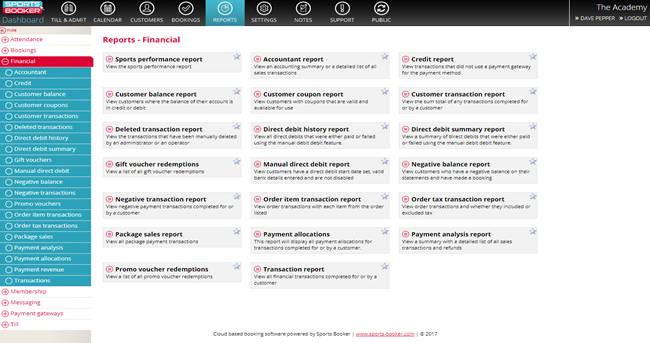

1. Go to the Reports section at the top of the dashboard. Click on the Financial sub menu and then on manual direct debit report.

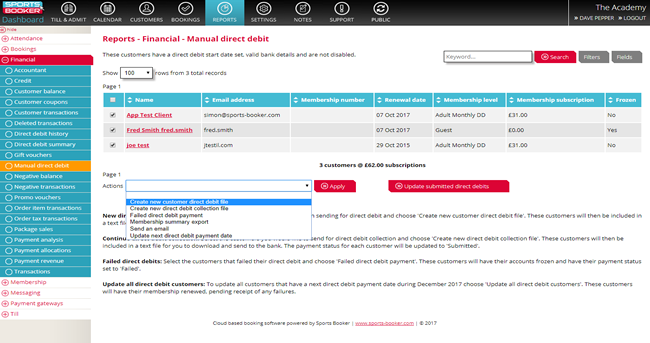

2. Select filters, quick filter and new direct debit customer.

3. Tag all the clients, and the apply the action of create new direct debit file.

This will create a file on you PC (in the download folder that your browser has set) for you to send to the bank with all the new mandates. Note: They will not be processed at this point for payment.

4. Shortly before your DD run date you then create the DD collection file, there is another quick filter to help you do this.

Tag the clients you wish to create the file for, and apply the action of create DD file. Note: This will only apply to those tagged or display on the screen, so you may need to change the number of records showing on a page.

5. When you click apply, their status will be changed to pending, as you have now created a file to send to the bank.

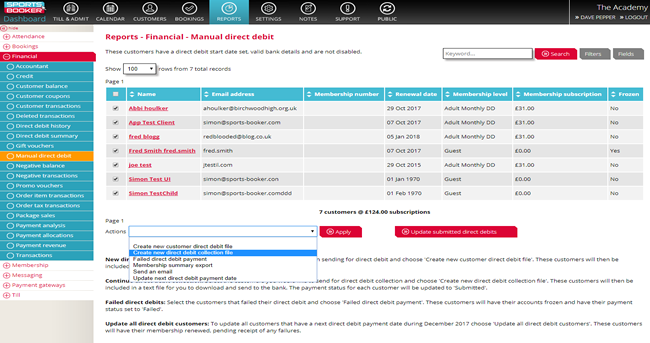

6. When you receive your list of failed and paid DD’s back from the bank, click on the button Update Pending Direct Debits.

7. All customers that have a payment status set to 'Pending' will be changed to 'Paid'. When you receive the list of direct debit failures from the bank use the 'Failed direct debits' action to update those customers and freeze their account.

Search

Search Payments

Payments